PIONEERING THE FUTURE OF A SUSTAINABLE PLASTICS ECONOMY

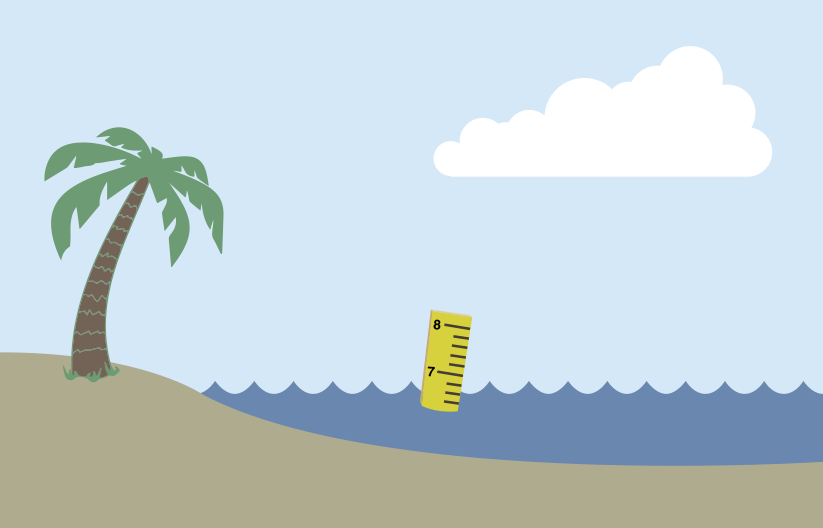

Advanced recycling company Mura Technology is aiming to become the world’s leading producer of recycled hydrocarbons from waste plastics - helping

to decarbonise the petrochemical industry and eliminate global plastic pollution.

"Dow Inc. is being position with Mirua Technology to fill in for Petroleum Hydrocarbon production …. The impact will be huge .. The conversion of

“plastic” into usable chemical building blocks which have required “Cracking Plants” to produce

https://muratechnology.com

"Dow Inc. (DOW) Q3 2022 Earnings Call Transcript

Dow Inc. (NYSE OW) OW)

Q3 2022 Earnings Conference Call

October 20, 2022 8:00 AM ET

Company Participants

Pankaj Gupta – Investor Relations, Vice President

Jim Fitterling – Chairman and Chief Executive Officer

Howard Ungerleider – President and Chief Financial Officer

Conference Call Participants

P.J. Juvekar – Citi

Hassan Ahmed – Alembic Global Advisors

Jeff Zekauskas – JPMorgan

David Begleiter – Deutsche Bank

Vincent Andrews – Morgan Stanley

Matt Skowronski – Credit Suisse

Christopher Parkinson – Mizuho

Josh Spector – UBS

Arun Viswanathan – RBC Capital Markets

Laurence Alexander – Jefferies

Jaideep Pandya – On Field Research

Presentation

Operator

Good day, and welcome to Dow’s Third Quarter 2022 Earnings Call. [Operator Instructions]

I will now hand over to Pankaj Gupta, Investor Relations, Vice President.

Pankaj Gupta

Good morning. Thank you for joining Dow’s third quarter earnings call. This call is available via webcast, and we have prepared slides to supplement

our comments today. They are posted on the Investor Relations section of Dow’s website and through the link to our webcast.

I am Pankaj Gupta, Dow Investor Relations Vice President. And joining me today on the call are Jim Fitterling, Dow’s Chairman and Chief Executive

Officer; and Howard Ungerleider, President and Chief Financial Officer.

Please read the forward-looking statement disclaimer contained in the earnings news release and slides. During our call, we will make forward-looking

statements regarding our expectations or predictions about the future. Because these statements are based on current assumptions and factors that

involve risks and uncertainties, our actual performance and results may differ materially from our forward-looking statements. Dow’s Forms 10-Q and

10-K include detailed discussions of principal risks and uncertainties which may cause such differences. Unless otherwise specified, all financials,

where applicable, exclude significant items. We will also refer to non-GAAP measures.

Where can I find a list of “must-have” stocks?

Unlock Seeking Alpha’s Top Rated Stocks for Free »

A reconciliation of the most directly comparable GAAP financial measure and other associated disclosures is contained in the Dow earnings release, in

the slides that supplement our comments today, as well as on the Dow website.

On Slide 2, you will see our agenda for the call. Jim will begin by reviewing our third quarter results and operating segment performance. Howard will

then share our outlook and modeling guidance. And then to close, Jim will discuss how our actions and long term strategic priorities enable us to

deliver value growth in a dynamic environment. Following that we will take you questions.

Now let me turn the call over to Jim.

Jim Fitterling

Thank you, Pankaj. Beginning on Slide 3, in the third quarter, team Dow continued to proactively navigate higher energy costs and geopolitical

uncertainties that are impacting consumer demand, particularly in Europe. As macroeconomic conditions began to erode in the quarter, we responded

quickly by implementing a set of actions to prioritize resources toward higher return products, align production rates to supply chain and logistics

constraints as well as demand and reduce operational costs across the enterprise.

In addition, our advantage portfolio enabled us to capitalize on demand strength in higher value functional polymers in Packaging & Specialty

Plastics, and performance silicones in Performance Materials & Coatings.

Third quarter net sales were $14.1 billion, with sales declines of 5% year-over-year and 10% quarter-over-quarter. Local price increased 3%

year-over-year with gains in Performance Materials & Coatings and Industrial Intermediates & Infrastructure. Sequentially, price declined 6%

and was down across all operating segments and regions.

Look at our Very Bullish Stocks and ask:

How would you ever find these? »

Volume was down 4% versus a year ago period as declines in Europe, the Middle East, Africa and India or EMEA more than offset volume growth in the

U.S. and Canada and Asia Pacific. Sequentially, volume was down 3% led by EMEA. Continued strength of the U.S. dollar also impacted net sales by 4%

year-over-year and 1% sequentially.

Operating EBIT for the quarter was $1.2 billion. Our consistent focus on cash flow generation and working capital management in the quarter supported

cash flow from operations of $1.9 billion or a conversion of 104% of EBITDA and free cash flow of $1.5 billion.

We returned $1.3 billion to shareholders in the quarter, including $800 million in share repurchases and $493 million in dividends. And our balance

sheet continues to have no substantive long-term debt maturities due until 2027.

Turning to our operating segment performance on Slide 4. In the Packaging & Specialty Plastics segment, net sales were $7.3 billion, down 5%

year-over-year as price gains and resilient demand in functional polymers were more than offset by lower polyethylene pricing. Sequentially, net sales

were down 11%, also driven by lower polyethylene prices with reduced volumes as we decreased operating rates in response to continued global marine

pack cargo logistics constraints and lower demand in EMEA.

Operating EBIT for the segment was $785 million, compared to $2 billion in the year ago period and $1.4 billion in the prior quarter. These results

were impacted primarily by higher raw material and energy costs and lower local prices.

Moving to the Industrial Intermediates & Infrastructure segment, net sales were $4.1 billion, down 9% from the year ago period with price gains in

both businesses. Volume was down as strong demand for pharmaceutical, agricultural, and energy applications in Industrial Solutions were more than

offset by declines in polyurethanes and construction chemicals due to inflationary pressures in EMEA, decreased consumer durable demand and the

slowing housing market. Sequentially, net sales were down 7% and stable volumes primarily in mobility end-markets were more than offset by lower local

price and currency.

Operating EBIT for the segment was $167 million compared to $713 million in the year ago period and $426 million in the prior year. As lower EMEA

demand and increased energy and raw material costs were partly offset by higher prices. Sequentially, operating EBIT margins declined by 560 basis

points on lower price and higher energy costs.

The outlook for you is very bullish.

Download the Seeking Alpha app »

And in the Performance Materials & Coatings segment, we reported net sales of $2.7 billion, up 5% year-over-year, with price gains in both

businesses and all regions. Volume was down as resilient demand in mobility and home care end-markets were more than offset by declines in building

and construction.

Sequentially, net sales were down 12%, driven primarily by lower demand and decreased local price for siloxanes due to supply additions in China as

well as with planned maintenance turnaround activity.

Operating EBIT for the segment was $302 million compared to $284 million in the year ago period as margins expanded by 20 basis points due to price

gains for both silicones and coatings applications. Sequentially, operating EBIT declined $259 million driven by lower prices for siloxanes and

increased raw material and energy costs.

I will now turn it over to Howard to review our outlook and actions on Slide 5.

Howard Ungerleider

Thank you, Jim. Turning to Slide 5, in the fourth quarter, we expect to continue navigating high inflation, supply chain constraints and the impact of

geopolitical tensions. In Europe, high energy and feed stock costs are driving record Eurozone inflation, reaching a new high of 10% in September. As

a result, we see reduced industrial production and consumer spending.

In China, COVID-19-related lockdowns continue to hinder economic activity with weaker than expected regional consumer spending and infrastructure

investments. That said, we’re seeing continued strength in the mobility sector, with automotive sales up more than 25% in September year-over-year.

In the U.S. healthy consumer spending and low unemployment rates have supported resilient underlying demand despite high inflation, with U.S. consumer

confidence rising in September for the third consecutive month. Looking forward, we’re closely monitoring the impact of rising interest rates on

demand.

And in Latin America, we continue to see robust demand for flexible food packaging and consumer durables, as well as transportation and infrastructure

end markets. To manage these evolving dynamics, we continue taking actions region by region and business by business.

Throughout the third quarter, Dow implemented plans to reduce natural gas consumption at our sites in Europe by more than 15% due to high energy

costs. In August, we also temporarily lowered our polyethylene nameplate capacity by 15% and have now implemented a cold furnace idling program at our

crackers for fixed and energy cost savings. In parallel, we continue to prioritize higher margin functional polymers to capitalize on continued demand

strength while working to ease logistics constraints along the U.S. Gulf Coast.

We’re also reducing operating rates and shifting production across polyurethane, siloxane and acrylic monomer assets in Europe to manage our costs

and our inventory levels. And as we plan for next year, we have additional actions focused on production optimization, turnaround spending, and

reductions in purchase services with the potential to deliver more than $1 billion in cost savings on a run rate basis.

Turning to Slide 6, you’ll see our current expectations for the fourth quarter. In the Packaging & Specialty Plastics segment, we see stable

demand for consumables and food packaging applications. We anticipate global energy markets to remain volatile in response to geopolitical dynamics as

well as weather in the northern hemisphere and continue to expect lower consumer spending primarily in Europe. While lower turnaround costs will be a

sequential tailwind, in total, we expect $150 million seasonal headwind for the segment versus the prior quarter.

In the Industrial Intermediates & Infrastructure segment, demand for energy applications, particularly in the U.S. and a seasonal increase in

deicing fluid demand are expected to positively impact the quarter. Inflationary pressures however continue to impact consumer durables and building a

construction demand particularly in Europe.

We also expect continued pressure on propylene oxide and MEG margins due to increased supply from producers in Asia. After completing major plan

maintenance activity in the prior quarter on a net basis, we expect similar dynamics with a typical seasonality on a sequential basis.

In the Performance Materials & Coatings segment, demand for personal care and mobility applications remain stable as consumers move toward holiday

season buying patterns. However, we also anticipate a seasonal decline in demand for coating applications. Lower spending on planned maintenance

activity will partially offset margin pressure from supply of both siloxane and acrylic monomers from Asia particularly to Europe. All in, we

anticipate a $250 million headwind for the segment.

So in total, for the fourth quarter, we expect a $400 million net EBITDA headwind compared to the third quarter. We have also provided updates to the

full year modeling inputs in the appendix of the presentation. Equity earnings have been revised to align with the current market conditions and the

weaker margins in Asia.

We’ve lowered full year CapEx from $2.1 billion to $1.9 billion, and the full year tax rate is now expected to be slightly higher than our prior

guidance due to the geographic mix and lower equity earnings. This upward pressure and the full year rate is also expected to increase the fourth

quarter tax rate to account for the typical year-to-date true up.

With that, I’ll turn it back to Jim.

Jim Fitterling

Thank you, Howard. Turning to Slide 7. As a result of our actions over the last several years, we’ve created a streamlined portfolio with unique

levers to manage through the current macro backdrop. We have global scale and leading positions across the diverse set of attractive market verticals,

geographies, and value chains.

This gives us significant flexibility to quickly respond to evolving demand trends and capture demand better than our peers. 65% of our production

capacity is in the cost advantage in Americas, and we have 2 to 3 times more LPG flexibility in Europe versus our peers. Our advantaged cost position

and unmatched feedstock and derivative flexibility enables us to optimize our margins and our commitment to operational and financial discipline

underpinned by a culture of benchmarking and a best owner mindset have resulted in a low cost operating model and strong cash conversion.

These advantages have served us well since spin, providing a solid financial foundation that supports long-term value creation despite the current

unprecedented events impacting the market.

Importantly, our early cycle growth investments and our efficiency programs are enabling us to raise our underlying mid-cycle earnings above

pre-pandemic levels. We’ve nearly tripled our three-year trailing cumulative free cash flow since spin across a variety of macro environments, and

we’ll continue to execute on levers to drive even higher cash flow, including working capital improvements, joint venture dividends and cash

interest savings. And our balance sheet is now the strongest it’s been in my more than 35 years with the company creating a solid financial position

that offers significant flexibility.

The combination of robust cash flow generation and a strong credit profile enables us to deploy capital in a disciplined and balanced manner as we

advance our decarbonize and grow strategy, while also consistently returning cash to our shareholders through the economic cycle.

Moving to Slide 8. In 2022, we expect to deliver an incremental underlying EBITDA run rate of approximately $300 million to $400 million, comprised of

$300 million from growth initiative across our operating segments, as well as $50 million to $100 million from efficiency levers.

We have two Alkoxylation investments coming online this year to serve high value home care and pharma end markets. Our 60 kiloton project in the

United States started up in the third quarter, and our 34 kiloton project in Spain is on track to start up in the fourth quarter. Our 150 kiloton FCDh

pilot plant in Louisiana is also on track to start up in the fourth quarter.

And year-to-date, we have completed 13 downstream silicones debottlenecking projects. Longer-term, we remain on track to grow underlying EBITDA by

greater than $3 billion by 2030 while reducing our carbon emissions by 30% versus our 2005 baseline. Our suite of higher return, lower risk, and

faster payback investments will deliver $2 billion in additional run rate EBITDA, while we also reduce our carbon emissions by approximately 2 million

metric tons by the middle of this decade. These investments target higher value applications that enable us to capitalize on increasing demand for

more sustainable and circular solutions.

Let me highlight a couple of examples. Our ENGAGE Elastomers increase the lifetime of solar panels and enable over 50 gigawatts of solar power

generation around the world. And we recently launched SiLASTIC, the world’s first silicone-based self-sealing tire solution that can be easily

recycled, which is being commercialized in upcoming Bridgestone tires under the technology name B-SEALS.

We also remain on track to reach preliminary investment decision by year end for our Path2Zero project in Alberta to build the world’s first zero

carbon emissions, ethylene and derivatives cracker complex, which will grow our global polyethylene supply by 15%, while the carbonizing 20% of our

global ethylene capacity.

This project will generate an additional $1 billion of underlying EBITDA by 2030. As we deliver on our growth strategy, we remain committed to the

discipline and balanced approach to capital allocation that has served us well since spin. Our first priority is to maintain safe and reliable

operations.

We continue to advance our growth investments with CapEx at or below D&A and drive return on invested capital greater than 13% across the economic

cycle. With adjusted debt-to-EBITDA inside our long-term target range of 2 to 2.5 times, we have the financial flexibility to deploy cash to maximize

long-term shareholder value creation, and we’re targeting to return 65% of our operating net income to shareholders. Since spin, we’ve exceeded

this target returning an average of 78%.

Turning to Slide 9, despite near-term macroeconomic challenges, innovating circular and sustainable solutions remains a key aspect of our long-term

decarbonize and grow strategy. We see increasing demand for these products, which represent a significant growth opportunity for Dow with attractive

pricing that will support longer-term higher quality earnings.

We have continued to accelerate our actions to capitalize on this opportunity and create a circular economy. And we recently announced a new

commitment to commercialize 3 million metric tons of circular and renewable plastic solutions annually by 2030. This new goal expands our

sustainability targets and our focus on advancing a circular plastics business platform to meet our customers increasing demands for more sustainable

and circular products as evidenced in the recent letter published by the Consumer Goods Forum, citing demand for advanced recycled plastic material.

To achieve this goal, we will exceed our original target to enable 1 million metric tons of plastic waste to be collected, used, reused or recycled,

and we’re well on our way as we scale a robust pipeline of more than 20 strategic collaborations to enable recycling infrastructure to partner

across the value chain to bring hard to recycle waste into the circular economy and to help communities address waste management and recycling gaps.

This includes our most recent and significant commitment to-date to scale advanced recycling with Mura Technology, which positions Dow to be the

largest consumer of recycled plastic feed stock for polyethylene globally.

These collaborations are a unique advantage as demand for circular solutions continues to grow. When you consider together this circular and renewable

sales target along with the additional capacity from our Alberta Project, in 2030, our combined circular, renewable and zero carbon emissions capacity

will comprise greater than 50% of our global polyethylene capacity.

I’ll close on Slide 10. Our strategic priorities remain unchanged. We will continue to operate with agility as we navigate the current market

dynamics as evidenced by our recent actions to balance production while ensuring we remain well positioned to capture demand as market conditions

improve. At the same time, we remain focused on executing our long-term growth strategy, expanding our competitive advantages and delivering on our

financial priorities to position the company for long-term success.

With that, I’ll turn it back to Pankaj to open up the Q&A.

Pankaj Gupta

Thank you, Jim. Now let’s move on to your questions. I would like to remind you that our forward-looking statements apply to both our prepared

remarks and the following Q&A. Operator, please provide the Q&A instructions.

Question-and-Answer Session

Operator

Thank you. [Operator Instructions] We will take the first question from P.J. Juvekar from Citi. Please go ahead.

P.J. Juvekar

Yes, good morning, Jim and Howard. With the IRA and CCS credit going to $85 per ton, are there any projects in CCS that you could deploy at your

existing plants that come into the money now that weren’t there before? And then secondly, on Europe, would you accelerate - incrementally would you

accelerate CapEx in the U.S. given the situation Europe is in? And then if Europe is not producing much chemicals, how does that impact in your mind

sort of the downstream automotive building and construction businesses in Europe? Thank you.

Jim Fitterling

Good morning, P.J. Two really good questions. I think when we look at the IRA, which has a lot of good elements in it for our sustainability agenda

both hydrogen and CCS as well as advanced nuclear. The challenge right now is where do you have the availability of the existing pipeline

infrastructure to get carbon off of an existing asset into a CCS category. That’s why we put the project in Terneuzen and the project in Alberta

first, because we have existing capacity there.

And I should say in Terneuzen not yet, but Terneuzen has got a plan in place to get it in place. This is going to help us get some infrastructure in

place in the U.S. Gulf Coast, so will make that possible. And as that becomes available, we’ll look at accelerating deployment here in the U.S. Gulf

Coast. And I would say $85 a ton, we think long-term, those numbers are probably going more towards a $100 a ton or higher. And that should really

help accelerate hydrogen and CCS.

On CapEx in the U.S. and the future of chemicals in Europe, third quarter, the two big challenges we had were – the biggest was primarily

electricity-related, and third quarter you saw European electricity cost go as high as €400 of megawatt hour, they’ve come off a little bit now

because natural gas has come off. About half of our footprint in Europe has advantaged electricity. So we did in the quarter was bring down rates to

the advantaged positions or kind of run and break even in Europe and obviously load other assets with that demand. I think in the short-term, you’re

seeing more product flow into Europe from the Middle East and some right now from China.

I think longer term we’re working with the governments through energy policy changes that are going to help. One of the reasons we announced the

project in STADA one of the five floating regas units that’ll be put in Germany to really help Germany diversify away from just solely Russian gas.

I think the European question, long-term will be in front of us through next year, but in the short-term, we’ve got a good game plan to navigate the

winter and to navigate next year, and that’s why we announce the billion dollars worth of cost reductions for 2023.

Operator

We will now take the next question from Hassan Ahmed from Alembic Global Advisors. Please go ahead.

Hassan Ahmed

Good morning, Jim and Howard. Just trying to reconcile the Q4 guidance you guys have given, it seems to me you’re guiding to an EBITDA of roughly

$1.45 billion. If that is the case, I’m just trying to sort of understand what sort of polyethylene pricing you’re baking into that guidance.

Because it just seems that there’s some price hikes on the table, some consultants are out there sort of doubting some of those price hikes going

through, so if you could provide any color around that?

Jim Fitterling

Thank you, Hassan. Good question. Obviously, we saw pricing in polyethylene through the third quarter decline. It started to stabilize the beginning

of the fourth quarter. Most of what’s in that, fourth quarter outlook is more stable pricing in polyethylene, but you get the dollar averaging that

happens through the quarter, so we start the lower pricing and it carries through the quarter.

Inventories came down on the Gulf Coast, stepped down from the high levels that they were in the third quarter, and so that’s helping and we’ve

seen some better Marine Packed Cargo logistics. We had good volumes out in the third quarter. We could have done more. And so we’re continuing to

try to work on the logistics constraints. And so most of what’s in there is dollar averaging, more stabilized pricing, and then a little bit of

tailwind because we have lower turnaround costs into the fourth quarter for polyethylene.

The other thing I would mention is that input costs are starting to look more favorable. We’ve started to see a little bit of improvement in the

ethylene chain. Oil is obviously – oil inventories continue to be low and natural gas production continues to be higher. And so that’s positive

skewed, I’d say the estimate skew to the upside if oil and gas continue on these trends.

Operator

We will now take the next question from Jeff Zekauskas from JPMorgan.

Jeff Zekauskas

Thanks very much. Two questions. Can you talk about MDI prices and volumes sequentially and your general expectations? And secondly, in Performance

Materials, there seems to be a fair amount of pressure in siloxane prices. Are we entering some kind of cyclical downturn in that business? And so

what we should expect is a relatively level of earnings from the fourth quarter going forward.

Jim Fitterling

Yes. Good morning, Jeff. Thank you for the question. On MDI in Industrial Intermediates & Infrastructure, the supply demand balances through the

middle part of the decade look good on MDI, where we’ve seen market weaknesses in consumer durables, mobility is held up pretty well. Electric

vehicles are really probably the shining star on growth in that space. But it’s housing and construction where we’ve seen the biggest weakness.

And then of course, appliances closely related to that. I would also say, what you see in the numbers and what you see in the guide, remember that we

have quite a bit of footprint in Europe, and so with the energy situation there that just really compresses the margins there. I think it’s less

pricing and less that issue than it is the input cost issue.

So that’s why we brought rates down to low levels in Europe. China also seeing housing and construction slow. And so I think we’ll see what

happens after we come out of this party Congress and whether we see a change in COVID restrictions that might signal that 2023 would be better. In

siloxanes capacity has come on in China and that’s really what’s brought the prices down. And we’re really back to the kind of the long-term

mid-cycle average prices for siloxanes in the marketplace, and yes, we expect that will continue into 2023. And so I think it’s more, the timing of

the supply coming on that’s put that pressure on.

Operator

We will now take the next question from David Begleiter from Deutsche Bank.

David Begleiter

Thank you. Good morning, Jim and Howard. Howard, just on modeling guidance. Does the $400 million of sequential EBIT headwinds fully capture the

seasonality in Q4 and is any benefit in the guidance from the $1 billion of cost savings you highlight today as well? Thank you.

Howard Ungerleider

Yes, good morning, David. So yes, look at an enterprise level, the short answer to your question is it does. So the $400 million net of really EBITDA

decline, I would call, half of that is enterprise level seasonality or typical Q3 to Q4 seasonality, and the other half is the averaging effect of the

margin decline that we saw through the third quarter. And then you’ve got two pieces that are kind of offsetting each other. The higher – the more

favorable turnarounds or the lower turnarounds that Jim mentioned that are getting offset by some currency headwinds that we’re seeing sequentially.

Embedded in that are some of those interventions that, we listed in the slide that’s in the earnings deck. So, we are already and have been

intervening since the beginning of the third quarter. So, we’re going to see that continue through the fourth quarter and then obviously in a bigger

way next year.

Operator

We will now take the next question from Vincent Andrews from Morgan Stanley.

Vincent Andrews

Thank you, and good morning everyone. Just wondering if you can talk a little bit more about sort of the delta between what you think underlying

demand is versus maybe some destocking that’s going on just given all the macro uncertainty out there. And part of what I’m getting at is,

you’ve obviously made some seasonality assumptions sequentially from 3Q to 4Q and just trying to understand, how much of what we’ve seen already

in terms of weak demand might have been a pull forward of what we might have previously thought could have happened more traditionally in November and

December. So just sort of any comments you have helping us bridge, sort of the weak volume with destocking versus underlying demand would be helpful.

Jim Fitterling

That’s a good question, Vince. Obviously the retail sector saw a lot of higher inventories and pulled back. I would say in automotive things are

still restricted primarily by those supply chains of all the different various parts coming together so the auto companies can make their deliveries.

That probably shows up more on internal combustion engine vehicles, somewhat on EVs, but EV growth in the U.S. and EV growth in China have been

really, really strong. So, I think that’s going to continue to be good.

Our outlook for automotive next year is 86 million light vehicles up from 80 million projection this year I think that’s good. Packaging, I don’t

think we saw a lot of destocking in packaging in the market. I would say, we saw adjustment to lower operating rates because of the slowdown of demand

in EMEA. EMEA being off 12% was a significant slowdown. Consumer pressures in EMEA are much stronger than even the consumer pressures here, and

they’re significant.

The durable goods and the consumer electronics is a tough one to call. They’re pretty tightly connected to housing. China housing is down 38%. Their

housing starts are down 38% year-over-year. So that’s a pretty low level. I’d say there’s opportunity for upside going into next year. The U.S.

has slowed down, but we’re still working off of finishes of houses that are under construction. And so I think the general consensus is demand is a

little bit slower for 2023 on housing here. The other bright spot is infrastructure, and so for those businesses that are tied to infrastructure we

still see very good infrastructure spending.

Operator

We will now take the next question from Michael Sison from Wells Fargo.

Unidentified Analyst

Hi, this is Richard on for Mike. Just wanted some color on the $1 billion in cost savings for 2023. Is any part of this embedded in the $3 billion to

$3.9 billion that you’re targeting to increase sort of the – your earnings range through the cycle? And also is that – does that also include

the temporary 15% reductions in polyethylene and maybe additional reductions in capacity, potentially in maybe II&I.

Jim Fitterling

Yes, that’s a good question, Richard. So, our target is to come up with more than a $billion in cost saves. I would break it down into a few

different buckets for you. One is, what we can do with optimizing our mix, so flexing the assets across geographies and product and application mix

tax when improve margins. The second would be what you talked about in terms of plant idlings were shutdowns. Right now we don’t have anything lined

up for shutdowns, but we obviously reduce rates for higher cost plants, and we’ll continue to do that, especially in Europe while energy costs

remain as high as they are.

And then we’re working on always things to drive operational excellence. And the other big moving part next year is, we’re going to reduce

turnaround spending. We’re starting to see commodities come down and input costs come down and some relief on freight and logistics costs. So,

we’ve got a big effort on purchased materials and freight and logistics to get costs down and also on purchased services including contract labor.

And then we’ve been implementing digital and acceleration of finishing those projects delivers bottom line margins and productivity to us.

So those are really the five big buckets that we’re working on. The target here, if you looked at the earnings corridor that we published back in

Investor Day, our 2023 lower end of that corridor is about $7.2 billion. So our efforts here are really driven to protect that earnings corridor that

we put out there. A lot of the path to zero project growth in that earnings corridor the Alberta project, which is a $1billion of underlying EBITDA

growth, starts in 2027. That project will come on in two phases between 2027 and 2030, but the other $2 billion comes on through the years as we bring

on these smaller, higher return, lower risk projects.

Operator

We will now take the next question from Kevin McCarthy from Vertical Research Partners.

Unidentified Analyst

Hi, good morning, this is Cory in for Kevin. Turning back to a question on the outlook. You had mentioned, benefits in the ethylene chain. What are

you baking to your 4Q outlook as it relates to ethane costs? And what is your view in light of today’s natural gas market backdrop? And then for the

cold furnace idling program, can you talk through or quantify what impact you expect it to have on fixed cost absorption at your reduced plants? Thank

you.

Jim Fitterling

Right. That’s a good question on ethane. I mentioned natural gas earlier. So gas production continues to be high, more than half a million barrels a

day of ethane in rejection that has really brought the frac spreads down. And so we’ve seen frac spreads come back down to about $0.33 a million

Btu, so off of some of the highs that we saw in first, second quarter. And I think our projection is it’s going to continue to be that way. Natural

gas productions and 100 Bcf a day right now. And the outlook for next year is 110 Bcf a day. There will be plenty of ethane available.

So, I think our feeling is, we expect through winter, $0.40 to $0.60 a gallon on depending on what happens with winter gas demand. That’s really

where it was, $0.35 to $0.65 in third quarter, and I think next year we’re going to see continued availability and lower pricing on ethane. And in

terms of the cold furnace idling, I don’t have a good number for you to estimate what that is. Essentially, the practice historically would’ve

been to keep those assets on hot standby and ready to go, but with the slower demand, there’s no need to do that. And with these higher gas costs,

taking them cold and then warming them back up is not going to penalize this in the marketplace.

Operator

We will now take the next question from Steve Byrne from BOA.

Unidentified Analyst

Thanks. It’s Matthew on for Steve. Can we talk about the trending functional polymers a bit? I think price was up year-over-year, but sounds like

maybe down sequentially. Did margins in that business improve quarter-over-quarter with base commodities deflating? And when we look at 4Q, does that

performance catch up on the downside or do you still think things should hold in pretty well?

Jim Fitterling

Yes. Thank you. Good question. Prices typically are pretty resilient through the cycle in, in that space. We saw prices flat really from

quarter-to-quarter, and so that margin declined a little bit because of the higher energy in raw material costs. But the demand continues to be good.

Demand in, in areas like commercial construction, which is, is holding up relatively well mixed use both residential and commercial buildings are

holding up pretty strong around the world and that takes a fair amount of material. Obviously products into automotive are holding up pretty well, and

then energy, energy infrastructure takes a lot from the wire and cable business and that continues to hold up well. So I think what you’ll see is,

they can – the margins can ebb and flow a little bit but the volumes and the price trends are very strong.

Operator

We will take the next question from John Roberts from Credit Suisse.

Matt Skowronski

Good morning, Jim and Howard. This is Matt Skowronski on for John. Some of the consultants have reported that polyethylene storage levels are very

high in North America. Would you consider taking operating rates lower than the 15% reduction you’ve already taken if demand weakens further and

then sitting here today, do you think it’s possible that further reductions in production will need to happen either through the end of this year or

early 2023?

Jim Fitterling

Thanks for the question. I think the storage levels primarily at the ports are waiting for ships to arrive to get the product out. A lot of that

product is packaged for the export market, so it isn’t that that product is going to magically turn around into the North American market. And with

what we see with demand growth in the North American market, I don’t see a reason to reduce operating rates any further. I’d also say Latin

American businesses holding up relatively well. So that gives us some opportunity as well. I think it’s going to be worked out as we get better ship

arrival times and better loading. I think you’re going to see those numbers deplete pretty quickly.

Howard Ungerleider

I would just also add the latest ACC data says that inventory levels actually decreased by 7% or about four days month-on-month. So I mean, I think

you still see fundamental demand in the United States and Canada hanging in there.

Operator

We will now take the next question from Christopher Parkinson from Mizuho.

Christopher Parkinson

Hi, good morning. I was just wondering if you can parse out a little bit, what end markets and regions, you saw the biggest shift in demand versus

kind of your original expectations in the second quarter and how those areas are trending into the fourth quarter. Now, is there any area where

you’re more optimistic or more concerned as we head into the end of the year in 2023? Thank you.

Jim Fitterling

Yes. Good question, Chris. So areas of strength are industrial electronics and think about telecom, 5G infrastructure, data centers and that continues

to be pretty good. There can be some supply chain constraints there, but they’re pretty strong. In industrial solutions we make intermediates and

incipients for the pharma industry. That demand has been strong; we’re looking at greater than 7% compound average growth rates through 2026. And so

that’s – I think that’s going to continue industrial solutions in general, as I would say has good growth trends and silicones, downstream

silicones in general have good growth trends.

Automotives we’re seeing some supply constraints easing and even those sales this year; deliveries this year are flat year-over-year really robust

EV growth especially in China. If you look at China, EVs are up 90% year-over-year and automotive in China is up 25% year-over-year; I think that’s

a bright spot. We expect to continue EVs in the United States also strong, and I expect that to continue. That’s good for us because two to three

times more silicone materials in the EVs and similar amount of materials that we would have in an internal combustion engine for things like

controlling noise, vibration and harshness. Infrastructure’s going to continue to be strong. There’s stimulus packages out there, many governments

around the world and that tends to pull a lot in functional polymers, which we just talked about. It will pull some polyurethanes and construction

materials that will pull some in coatings in that infrastructure space and some into our industrial solutions.

In plastics it tends to pull in things like water pipelines, natural gas pipelines, I think we’ll continue to see that grow. Steady markets, I would

say would be oil and gas. We’re starting to see an uptick in oil and gas production that pools a means from our industrial solutions business.

Personal care has been very resilient. Cosmetics have come back after a soft second quarter in China and packaging for food. And so the issues in

packaging are really more, not demand, but really more the higher energy cost and slowing economic activity in Europe.

And then places where I mentioned before a week are related to housing and big ticket items, so appliances, food and beverage activities like

furniture and bedding, I mean, not food and beverage, appliances and furniture and bedding slowed down third quarter and into fourth quarter. And then

consumer electronics slowed down as well, large TVs, large home PCs and electronic devices.

Residential softening here in the U.S., Europe, also in China but commercial construction has been relatively good; mixed residential and commercial

buildings especially in big cities. I think next year, India, U.S., Canada, Latin America will be bright spots. We’ll still have to manage through

Europe and the situation with Russia/Ukraine having the biggest impact there. And then China we had our – we had our best quarter in China. We were

up 13% quarter-over-quarter and 7% year-over-year in volume and could have been better with the ability to get more plastics out of the Gulf Coast. So

I think there’s been a lot of concern about what they’ve reported or not reported, but our view is that demand has been good.

Operator

We will now take the next question from Josh Spector from UBS.

Josh Spector

Yes. Hi, good morning. So I was curious if there is a way to think about the costs you guys are absorbing in Europe from higher energy. So we think

about 3Q and 4Q expectations versus the level of 2Q. Is there any way to quantify how much you feel like you’ve had to absorb and not be able to

kind of shift away from flexing your production or through pricing or other means? So if pricing or energy prices were to move down would demand

environment remains similar? How would you think that would play out? Thanks.

Jim Fitterling

Simple answer two-thirds of the total EBITDA decline in third quarter whether it was versus previous quarter or last year was in EMEAI, and that’s

the impact of high inflation, elevated energy costs on our raw materials and then what that high inflation has done to consumer demand in EMEAI.

Volume was down 12% in the quarter in EMEAI.

Operator

We will now take the next question from Arun Viswanathan from RBC Capital Markets.

Arun Viswanathan

Great, thanks for taking my question. Good morning. So my question is around North America and potential, your outlook there. I know Europe was

responsible for two-thirds of the weakness in Q3 and its likely been the case for a little while now. Are you at all concerned of a weakness that

could emerge in North America? Is North America just a little bit behind Europe and China and the weakness that you’re seeing there? I mean, I guess

you’re not seeing China weakness, but, but on Europe? And what are some of the factors that would differentiate and keep North America a little bit

more resilient? Maybe you can touch on inventories or supply demand or anything else. Thanks.

Jim Fitterling

Well, the cost position that we have in the Americas is very advantaged and so I think that’s the most important thing to keep in mind. The consumer

demand has been strong especially consumer non-durables, consumer discretionary has been good. I would say big ticket items, like I mentioned have

already slowed this year. So if anything, there’s a chance for upside next year. I think that same is true on automotive, automotives really been

supply constrained.

And so we get through some of that. We’ll start to see that move up. We’re starting to see and here, I’m not talking just about Dow’s

business, but we’re starting to see prices come down in bulk commodities. It takes those prices a while to work through the fabrication shops and

get themselves into the price of a product that a consumer would buy in the store. So those prices have come down through the year, and I think

you’ll start to see those show up in the consumer markets next year and that may actually help things improve.

European energy situation is totally different than the United States. And right now we’re trying to work through how we can help the governments

get to a better energy policy that will help them out. I think that’ll be the biggest improvement globally that’ll help the economy move.

Operator

We will now take the next question from Aleksey Yefremov from KeyBanc Capital Markets. Please go ahead.

Unidentified Analyst

Hi, this is Paul on for Aleksey. As we approach winter, how are you guys managing the cost front in both the U.S. and Europe, and do you see the

potential for any idling of assets in Europe maybe not your assets but just probably in the industry? Thanks.

Jim Fitterling

Yes, I think we have seen in energy intensive industries in Europe like steel and aluminum already idling of assets a lot. Maybe not complete closure,

some energy intensive industries, complete closure may jeopardize the long-term, probability of starting them back up. But lot of pressure on smaller

producers in Europe, especially having some scale matters and having good advantage cost positions matters. About half of our energy footprint in

Europe is advantaged. And so we’ve dialed back to those rates to take advantage of that cost layer, and then we’ve loaded that demand onto other

locations that are more cost advantage.

We’ll continue to do that. I think the other answer to shutdowns is going to be whether we see a way through the energy policy situation. The longer

we stay in this situation, the longer the Russia/Ukraine situation lasts; it’ll put more pressure on the industry to take a look at rationalizing.

And they’ve already got a lot of pressure’s there. They need government help more than anything.

Operator

We will take the next question from Laurence Alexander from Jefferies.

Laurence Alexander

Good morning. So can you describe how you’re thinking about CapEx flexibility over the next couple of years given the, we’re given the credit

cycle in prior cycles, Dow’s tended more to look at retrenching, but as you look at the investments required for the circular economy initiatives,

could you pull forward or be opportunistic in expanding sort of what you do in that value chain as other people retrench?

Jim Fitterling

Good question, Laurence and obviously we’re trying to have the financial flexibility to keep moving on those projects because I don’t think

long-term any of those trends are going to change. We see the consumer demand throughout the year in spite of what’s going on in the global macro

economy. Consumer has come back to us consistently wanting more and more, more of both mechanical recycled, advanced recycle products and products

made with bio-based ingredients, more renewable products and that’s what we’re investing in.

Some of it’s our capital, some of it is joint capital together with partners, like I mentioned with Mura Technologies. We have about 20 projects in

plastics today. We had a 1 million metric ton target and we have good line of sight to be able to deliver the 1 million and we just increased it to 3

million metric tons of circular and renewable solutions by 2030, mainly because of those brand owners who are telling us the demand is there for those

products.

And so we will keep those projects moving forward. We will keep our decarbonization and Path2Zero projects moving forward. Obviously we’re going to

be disciplined about it. Most of the monies that we spend on Path2Zero right now are engineering dollars, and we will not pull the trigger and start

those projects until we see the bulk contracts for steel and fabricated products and long lead time items in the right range. And when we see that

we’ll be ready to go. And I think in this next wave, we’ll have first mover advantage with the Canadian project, just like we did with the U.S.

Gulf Project that started up in 2017.

Operator

We will now take the next question from Jaideep Pandya from On Field Research.

Jaideep Pandya

The first is on the siloxane value chain, could you just tell us what is the current cost differential between Europe versus the U.S. and China on a

lended cost basis, if you include the energy cost? And given that significant supplies coming in China in the next 12 to 18 months, especially in

Xinjiang and Yunnan what do you expect for siloxane utilization outside of China? That’s my first question. And the second question really is around

the ethylene oxide MEG chain. This chain has done extremely well for not just yourselves, but a lot of your peers as well. And again, we are starting

to see as freight rates normalize product come out of China. So what do you expect the EO chain in 2023 and 2024? Do you expect a normalization or do

you think that demand is going to continue to be good? Thanks a lot.

Jim Fitterling

The siloxane prices that are available there in China become available in all the regions around the world already. So I think it’s already at that

spot. Silicone metals market prices are down a bit mainly just because demand and some higher volume applications are down, higher volume applications

related to building construction. But that I think is going to steadily improve. I would expect it to be in these levels in 2023. And then as we see,

inflation coming down, which I do believe it will, I think you’ll see the demands start to pick back up again and things will tighten back up.

Let’s put more pressure on Europe, I would say than North America. And that’s why we took some slower rates in our UK facility. On EO demand was

that the second half of the question?

Jaideep Pandya

EO and MEG?

Jim Fitterling

EO and MEG. MEG is the weak spot in EO. If you look at our industrial solutions strategy, it is to keep investing in high value EO applications. And

so all the alkoxylate investments that you see, investments in our oil and gas franchise for means those are continuing to do very, very well. And

we’re going to continue investing there to try to increase the amount of business that goes to those higher value applications for purified EO and

away from MEG.

MEG prices were actually at a low spot in the third quarter and had improved a little bit since because of falling inventories. I think a big part is

going to be dependent on higher China activity after they stopped the zero COVID lockdowns.

Pankaj Gupta

Yes. Thanks everyone for joining our call. I think that’s all the time we have for today. We appreciate your interest in Dow. For your reference a

copy of our transcript will be posted on Dow’s website within approximately 24-hours. This concludes our call. Thanks once again.

Operator

Thank you. That will conclude today’s conference call. Thank you for your participation. Ladies and gentlemen, you may now disconnect."

|

OW)

OW)