| Pages:

1

2

3

4 |

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

this thread reminds me of FMM discussions

"They never ask for it"

"I never had one in 2o years"

"Why bother?"

"I read something different"

usually coming from folks who are pretty vocal about "Illegals" in the US

rules are only for brown people

how dare the brown people creating uncomfortable rules

Harald Pietschmann

|

|

|

Bajaboy

Ultra Nomad

Posts: 4375

Registered: 10-9-2003

Location: Bahia Asuncion, BCS, Mexico

Member Is Offline

|

|

Quote: Originally posted by 4x4abc  | this thread reminds me of FMM discussions

"They never ask for it"

"I never had one in 2o years"

"Why bother?"

"I read something different"

usually coming from folks who are pretty vocal about "Illegals" in the US

rules are only for brown people

how dare the brown people creating uncomfortable rules |

B-I-N-G-O!

|

|

|

mtgoat666

Platinum Nomad

Posts: 20570

Registered: 9-16-2006

Location: San Diego

Member Is Offline

Mood: Hot n spicy

|

|

Quote: Originally posted by 4x4abc  | this thread reminds me of FMM discussions

"They never ask for it"

"I never had one in 2o years"

"Why bother?"

"I read something different"

usually coming from folks who are pretty vocal about "Illegals" in the US

rules are only for brown people

how dare the brown people creating uncomfortable rules |

Sometimes Americans are pretty full of themselves!

Woke!

Hands off!

“Por el bien de todos, primero los pobres.”

“...ask not what your country can do for you – ask what you can do for your country.” “My fellow citizens of the world: ask not what America

will do for you, but what together we can do for the freedom of man.”

Pronoun: the royal we

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

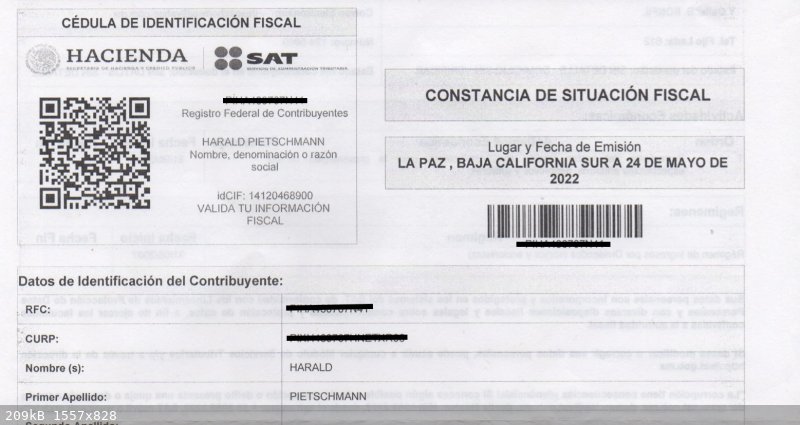

got my RFC number and my "Constancia de Situación Fiscal" this morning.

Waiting one hour in line (it was frigging cold!) at Hacienda

painless

no online hoops to jump through

start at 7:30

wait 40 minutes outside Hacienda

no information which line to chose

8:10 woman comes out and collects ID cards

8:40 she comes back with your ID and the new papers.

happy!

[Edited on 5-24-2022 by 4x4abc]

Harald Pietschmann

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by lencho  |

Wait, you didn't have an RFC before now, with your rental business and all?

How'd you manage to run without it?  |

I have had an RFC for my business for a long time

now everyone has to also get a personal RFC (Mexico may seem backwards - but in terms of taxes they are cutting edge)

and everyone is forced to get a Constancia de Situación Fiscal by July

Harald Pietschmann

|

|

|

gnukid

Ultra Nomad

Posts: 4411

Registered: 7-2-2006

Member Is Offline

|

|

Everyone (foreigners) are requested to create a Constancia de Situación Fiscal by July 21, 2022 but the system is failing applicants, therefore they

will not be able to complete this request.

|

|

|

Don Pisto

Banned

Posts: 1282

Registered: 8-1-2018

Location: El Pescador

Member Is Offline

Mood: weary like everyone else

|

|

again just passing this along....Don Rafa still isn't quite buying into this but he'll be the first to admit this isn't his area of expertise but he's

trying to sort it all out.

Registration in the RFC

2.4.14. For the purposes of articles 22 and 24 of the CFF Regulations, registration in the RFC is

will be carried out in the following terms:

V. The registration of individuals residing in Mexico and resident individuals abroad with and without a permanent establishment in Mexico, according

to procedure 39/CFF "Request for registration in the RFC of natural persons", contained in Annex 1-A.

The registration of individuals without economic activity, in accordance with procedure 3/CFF "Request for registration in the RFC of natural persons

with CURP" and 39/CFF "Request for registration in the RFC for individuals ", contained in Annex 1-A.

.

VII. Registration of trusts, according to the procedure file 43/CFF "Request for registration in the RFC for legal entities in the ADSC", contained in

the Annex 1-A.

None of these apply to foreign legal residents of Mexic, I will wait for confirmation from the notaries that I have consulted.

there's only two things in life but I forget what they are........

John Hiatt

|

|

|

Don Pisto

Banned

Posts: 1282

Registered: 8-1-2018

Location: El Pescador

Member Is Offline

Mood: weary like everyone else

|

|

a bit more......

Baseless rumors concerning SAT and a Tax id number.

The Lemming effect.

I sent inquiries to 3 different notaries in 2 states concerning the legal obligation for foreign legal residents of Mexico to have a tax id. I will

say it for the last time: There is no legal obligation for foreign individuals to get a tax id in this country unless you generate income in Mexico,

salary, rents, commissions, a business, etc. You don't need one, except if you wish to obtain an exemption on the capital gains tax resulting from the

sale of your house.

This is the consensus from the 3 notaries:

"It is my understanding that this is not an obligation for foreign legal residents, consult with a CPA"

If you do not fall under any of the previously outlined cases and you are still registering with SAT then there is nothing I can add except to say

that you fell prey to unfounded rumors.

Ex-pat magazines and forums proposing to get a tax id should acknowledge the mistake and quit stirring baseless fears and exposing foreign nationals

that will now be at the mercy of a merciless leftist federal government that is known to freeze bank accounts on mere suspicion and ignoring due

process.

One of the objectives of this legal blog is to promote awareness based on factual information, nothing else. I have written enough and provided legal

analysis of the reform and concluded that this obligation applies only to foreign legal residents of Mexico with income generated here, those with a

business or homeowners wishing to get a tax exemption on capital gains.

Best of luck with the consequences of reacting to unfounded rumors.

Regards,

Rafael Solorzano.

there's only two things in life but I forget what they are........

John Hiatt

|

|

|

Sandlefoot

Nomad

Posts: 220

Registered: 10-31-2011

Location: La Paz

Member Is Offline

Mood: Home

|

|

Rafael Solorzano

Admin

·

psotS513c6gu

2

07191

h

·

Baseless rumors concerning SAT and a Tax id number.

The Lemming effect.

I sent inquiries to 3 different notaries in 2 states concerning the legal obligation for foreign legal residents of Mexico to have a tax id. I will

say it for the last time: There is no legal obligation for foreign individuals to get a tax id in this country unless you generate income in Mexico,

salary, rents, commissions, a business, etc. You don't need one, except if you wish to obtain an exemption on the capital gains tax resulting from the

sale of your house.

This is the consensus from the 3 notaries:

"It is my understanding that this is not an obligation for foreign legal residents, consult with a CPA"

If you do not fall under any of the previously outlined cases and you are still registering with SAT then there is nothing I can add except to say

that you fell prey to unfounded rumors.

Ex-pat magazines and forums proposing to get a tax id should acknowledge the mistake and quit stirring baseless fears and exposing foreign nationals

that will now be at the mercy of a merciless leftist federal government that is known to freeze bank accounts on mere suspicion and ignoring due

process.

One of the objectives of this legal blog is to promote awareness based on factual information, nothing else. I have written enough and provided legal

analysis of the reform and concluded that this obligation applies only to foreign legal residents of Mexico with income generated here, those with a

business or homeowners wishing to get a tax exemption on capital gains.

Best of luck with the consequences of reacting to unfounded rumors.

Regards,

Rafael Solorzano.

" Don't find fault, find a remedy; anyone can complain." Henry Ford

If you are not living on the edge...you are taking up to much space!

Just because it may not be a good idea does not mean it will not be fun!!!

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Rafael Solorzano.

I asked him not long ago about reverse mortgages in Mexico

"There is no such thing in Mexico!" he answered

Well, Hipoteca inversa is relatively new in Mexico - but it does exist.

https://www.bbva.com/es/consiste-una-hipoteca-inversa/

so much for credibility Señor Solorzano

Harald Pietschmann

|

|

|

Bajaboy

Ultra Nomad

Posts: 4375

Registered: 10-9-2003

Location: Bahia Asuncion, BCS, Mexico

Member Is Offline

|

|

Quote: Originally posted by Don Pisto  | a bit more......

Baseless rumors concerning SAT and a Tax id number.

The Lemming effect.

I sent inquiries to 3 different notaries in 2 states concerning the legal obligation for foreign legal residents of Mexico to have a tax id. I will

say it for the last time: There is no legal obligation for foreign individuals to get a tax id in this country unless you generate income in Mexico,

salary, rents, commissions, a business, etc. You don't need one, except if you wish to obtain an exemption on the capital gains tax resulting from the

sale of your house.

This is the consensus from the 3 notaries:

"It is my understanding that this is not an obligation for foreign legal residents, consult with a CPA"

If you do not fall under any of the previously outlined cases and you are still registering with SAT then there is nothing I can add except to say

that you fell prey to unfounded rumors.

Ex-pat magazines and forums proposing to get a tax id should acknowledge the mistake and quit stirring baseless fears and exposing foreign nationals

that will now be at the mercy of a merciless leftist federal government that is known to freeze bank accounts on mere suspicion and ignoring due

process.

One of the objectives of this legal blog is to promote awareness based on factual information, nothing else. I have written enough and provided legal

analysis of the reform and concluded that this obligation applies only to foreign legal residents of Mexico with income generated here, those with a

business or homeowners wishing to get a tax exemption on capital gains.

Best of luck with the consequences of reacting to unfounded rumors.

Regards,

Rafael Solorzano. |

I'll let CFE know that the almighty Rafael said I didn't have to provide a RFC I'm meeting with my attorney next week. So far, he seems to think differently on the matter.

I'm meeting with my attorney next week. So far, he seems to think differently on the matter.

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by lencho  |

That document discusses Spanish law but I saw no indication that it applies to Mexico.

Did I miss something?  |

try this one:

https://www.bbva.com/es/la-hipoteca-inversa-en-mexico-como-m...

Harald Pietschmann

|

|

|

bajatrailrider

Ultra Nomad

Posts: 2522

Registered: 1-24-2015

Location: Mexico

Member Is Offline

Mood: Happy

|

|

So to understand this if you have no income in Mexico . You need not deal with this

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

ANY resident - income or not, must have an RFC and Constancia de Situación Fiscal by the end of June.

https://www.youtube.com/watch?v=H10dldg_r20

Harald Pietschmann

|

|

|

mtgoat666

Platinum Nomad

Posts: 20570

Registered: 9-16-2006

Location: San Diego

Member Is Offline

Mood: Hot n spicy

|

|

Quote: Originally posted by Don Pisto  |

I sent inquiries to 3 different notaries in 2 states concerning the legal obligation for foreign legal residents of Mexico to have a tax id.

This is the consensus from the 3 notaries:

"It is my understanding that this is not an obligation for foreign legal residents, consult with a CPA"

Regards,

Rafael Solorzano. |

So Rafael (whoever that is) posted what the notary said, but did not consult with a CPA, as the notary recommended.

But since it’s on the internet, it must be true!

Woke!

Hands off!

“Por el bien de todos, primero los pobres.”

“...ask not what your country can do for you – ask what you can do for your country.” “My fellow citizens of the world: ask not what America

will do for you, but what together we can do for the freedom of man.”

Pronoun: the royal we

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by akmaxx  | Did you bring the list of things they wanted (CFE bill, etc, etc) and did you make an appt. online? Or did you just go down to the malecon with your

RP card and it all worked out?

|

you line up before 8:00 (right line) outside the Hacienda on the Malecon.

Shortly after 8:00 an employee comes out and collects ID cards

she came back about 40 minutes later with the Constancia de Situación Fiscal

I was told, you would also get an RFC

as it turned out that is not correct

only if you already had some interaction with Hacienda before (and maybe a business RFC) then you will get a personal RFC and the Constancia de

Situación Fiscal

if you never had interaction with Hacienda before or an RFC then they will send you back home

there you will have to complete the online process of getting an RFC

https://www.youtube.com/watch?v=eh2li1L6mA8&t=239s

Harald Pietschmann

|

|

|

RFClark

Super Nomad

Posts: 2470

Registered: 8-27-2015

Member Is Offline

Mood: Delighted with 2024 and looking forward to 2025

|

|

Harold,

It doesn’t do any good to line out your number and leave the bar codes!

It seems that if you don’t have a CURP code you’re not a part of this process!

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by RFClark  | Harold,

It doesn’t do any good to line out your number and leave the bar codes!

It seems that if you don’t have a CURP code you’re not a part of this process! |

the law says "any resident" - as a resident (temp or perm) you have a CURP

Harald Pietschmann

|

|

|

SFandH

Elite Nomad

Posts: 7456

Registered: 8-5-2011

Member Is Offline

|

|

"the law"

I'd like to read it.

Do you have a reference for that or are you going by the videos you posted?

|

|

|

4x4abc

Ultra Nomad

Posts: 4454

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by SFandH  |

"the law"

I'd like to read it.

Do you have a reference for that or are you going by the videos you posted? |

Código Fiscal de la Federación, artículo 27, apartado C, fracción VIII.

https://leyes-mx.com/codigo_fiscal_de_la_federacion/27.htm

[Edited on 5-25-2022 by 4x4abc]

Harald Pietschmann

|

|

|

| Pages:

1

2

3

4 |